Malaysia Decrease Import Duty of Car

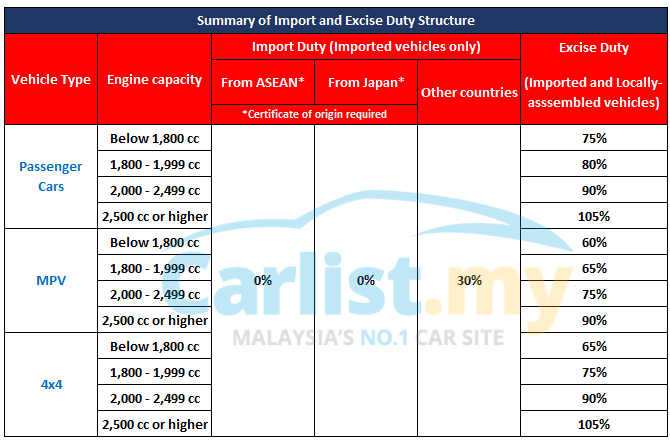

It comes down to the total price though and this is affected by the excise tax. Import duty on various car segments according to their CIF values.

Do You Know That Malaysia Is Known For Having One Of The World S Highest Taxes On Cars Ezauto My

The import duty on passenger cars with petrol engines range between 140 and.

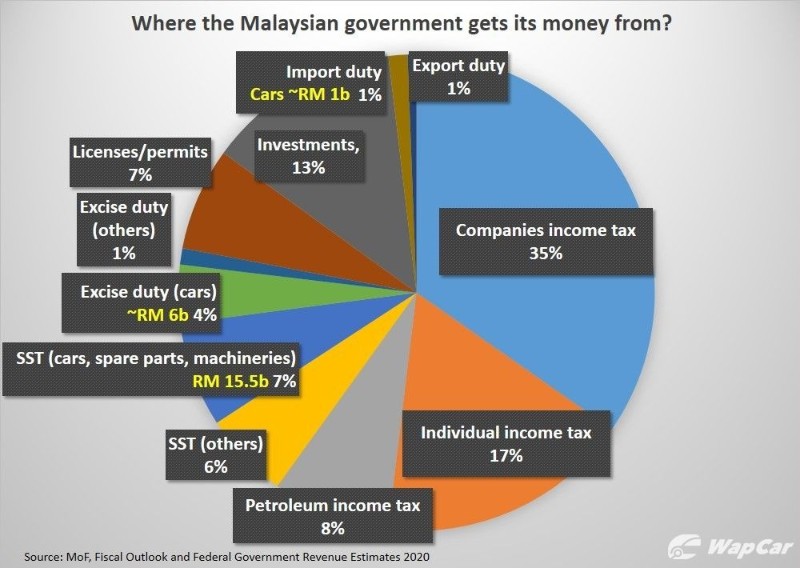

. The government has decreased import duty of Malaysian automotive products. Excise duties ranged between 75 percent to 105 percent and are calculated depending on engine capacity. If you compare the actual price of the vehicle the amount that you would pay isnt too bad.

This is only for sedan vehicles. For example take a sedan car for instance the excise duties on cars below 1800cc are 75. Most of the countries have local taxes of less than 20 whereas Malaysia has an excise tax of 105.

Used Audi A4 can be found in Malaysia at a pretty affordable price. Updated March 3 2013 935 pm ET. Car prices are further escalated by the tax rate and excise duty imposed.

TEMPO Interactive Jakarta. Cars above 1800cc-1999cc stands at 80 car above 2000cc-2499cc stands at 90 whereas cars above 2500cc at 105. Laptops electric guitars and other electronic products.

Cars imported from countries or are subjected to 30 percent import duty. Malaysia takes steps to gradually scrap an import tax on cars shipped from Japan and Australia. The duty of a completely built up CBU car is decreased from 20 percent to five percent.

It remains 0 percent. 03 6203 4485 03 6203 3022. Toyota Mark X Toyota Land Cruiser Honda Fit and some more are also very popular as used car in Malaysia.

Malaysia Reduces Import Tax on Some Foreign Cars By Jason Ng. Some goods are not subject to duty eg. The Customs department of Malaysia has their own method of calculating the open market value of certain vehicle models.

Vehicle must be registered under the applicants name for a period of not less than nine 9 months from the date of vehicle registration to the date of return to Malaysia. Now that Malaysia is in a recovery period from the 3-month standstill during the Movement Control Order MCO Barjoyai said that it would be a good chance for the government to test the impact of. You can personally arrange for the shipping with the automobile association or agents in your home country and then if you wish contact AAM Automobile Association of Malaysia to assist in the clearance of the car at the port or to recommend good local agents.

Hundreds of Japan used cars imported in Malaysia in the year of 2018. At present imported cars are subject to an excise duty of between 60 and 105 based on the model and engine capacity while import duty can be. PETALING JAYA 23 June 2020 An economist has proposed that duties be removed on imported cars for six months as a trial towards ending protectionist measures for the Malaysian motor industry.

Vehicles sales value and import value in accordance with the policies and legislations related to sales tax. The car is inspected by PUSKAPOM the Malaysian vehicle inspection agency. By the way ASEAN is short of Association of South East Asian Nations its a trade bloc but many locals confuse it with Asian and read it as such.

This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the. KUALA LUMPUR Oct 29-- The government intends to provide full exemption on import and excise duties as well as sales tax for electric vehicles EV to support development of the local EV industry. KUALA LUMPUR Dec 31 Reuters - Malaysia cut import duties on cars on Wednesday a year ahead of schedule but imposed excise duties of.

Conditions that need to be fulfilled to qualify for an Import License for a private motor vehicle. Once the car arrives in Malaysia the owner must collect it in person from the port of entry. Contact AAMs Head Office at 603 5511 1932.

Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up to 30 depending on the vehicles country of. In Malaysia no import duty is imposed for cars originating from Asean countries while 30 import duty is imposed on vehicles imported from non-Asean countries. 50 sales tax exemption for the purchase of imported cars also referred to as completely built-up CBU cars Currently the sales tax for vehicles is set at 10 for both locally assembled and imported cars.

The tax ranges from 75 to 105 depending on the car cc. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. When Malaysia signed the ASEAN Free Trade Agreement AFTA in 2004 we agreed to abolish import duties for cars so long as at least 60 percent of its value come from ASEAN-sourced parts.

Excise duty is between 60 and 105 calculated based on the car and its engine capacity while import duty can go as high as 30 depending on the vehicles country of. The custom duty will basically depend upon the declared value of the car that is being brought into the country. Speaking to FMT Barjoyai Bardai said Malaysia would ultimately have to dismantle all forms of protection for the industry.

The tax which was introduced is called excise duties. Toyota Vellfire is sold by Toyota along with Alphard to Malaysia. Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said the road tax exemption of up to 100 per cent will be given for EVs in addition to individual tax relief of up.

Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and on goods imported into Malaysia. According to Malaysian Automotive Association MAA the excise duty imposed on cars ranges from 65 to 105 on top of the. Level 15 Block 10 Jalan Duta 50622 Kuala Lumpur.

SALES TAX CONCEPT 3. With the exemption in place it means that the sales tax is fully waived for locally assembled car or charged at 5 for imported cars. However the government did not decrease completely knock-down KCD car.

Residing overseas legally for a period of not less than one 1 year. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars. Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

New Excise Duty Rules May Increase Ckd Car Prices By Up To 20 From 2023 Maa Appealing For Extension Paultan Org

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Importing Cars In Malaysia Expatgo

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

0 Response to "Malaysia Decrease Import Duty of Car"

Post a Comment